Let's Discuss Your Investment Strategy!

Request a Complimentary Meeting

Don’t Settle For Less

ABOUT BRIDGEPORT ASSET MANAGEMENT, LLC

Bridgeport Asset Management, LLC. (BAM) is a Registered Investment Adviser Firm, licensed with the State of Wisconsin Department of Financial Institutions. William J. Walsh, owner, has been securities licensed and registered as an Investment Adviser Representative since 1997 and 1998 respectively.

Bridgeport Asset Management, LLC. (BAM) is a Registered Investment Adviser Firm, licensed with the State of Wisconsin Department of Financial Institutions. William J. Walsh, owner, has been securities licensed and registered as an Investment Adviser Representative since 1997 and 1998 respectively.

Mr. Walsh graduated from the University of Wisconsin – Madison in 1995 with a Bachelor of Science degree in Economics, with an emphasis in Finance and Investments.

Mr. Walsh is a Retirement Income Certified Professional (RICP®) and an Accredited Portfolio Management Advisor (APMA®).

BAM provides Investment Management services to clients wishing to have their investments managed continuously on a discretionary or non-discretionary basis. BAM is available to provide management services to a wide variety of clients including, but not limited to, individuals, businesses, trusts, estates, corporations, pension and profit-sharing plans, employer sponsored retirement plans and its employees, as well as other like entities.

Being an RICP®, Mr. Walsh aids clients in preparing for and landing them into retirement. This process typically starts with discussing Social Security claiming strategies and choosing any pension plan payout option. This process also involves laying out the timing of income streams from retirement accounts, with the back-drop of minimizing taxes and medicare premiums. Retirement is more about managing the client’s income plan and typically involves adjustments along the way.

Investment Advice

Guidance and recommendations to inform, educate and guide an investor in choosing an appropriate investment strategy and creating a diversified mix of prudent investments.

Fiduciary Services

We act as a fiduciary, agent or trustee on behalf of a person or business for the purpose of administration, management of assets to a beneficial party.

Custom Portfolios

A carefully selected collection of assets that is specifically designed to reflect your risk tolerance in a specific time frame to optimize your investment goals.

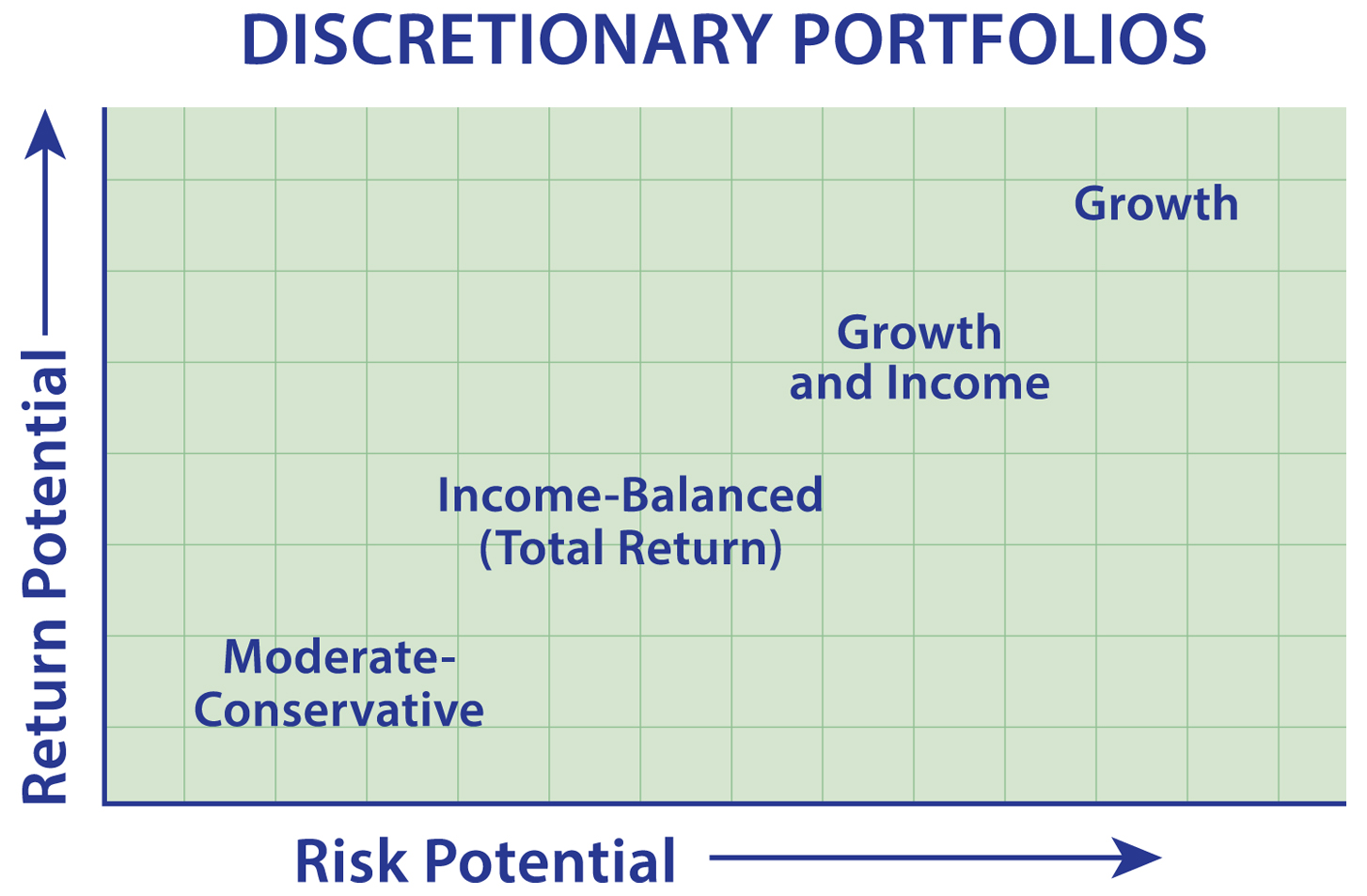

Investment strategies adopted by BAM for the client, generally start with learning what the client’s objectives are. A risk assessment is typically taken to act as a starting point as to how their assets should be invested. BAM creates and manages, on a discretionary basis, its own Portfolios, based on investment objective.

BAM will periodically consult with the client to confirm their investment or account objectives have not changed. If so, then we consider other strategies and Portfolios to best meet those needs and goals.

BAM’s Portfolios (Moderate-Conservative, Income-Balanced (Total Return), Growth and Income, and Growth) are managed on a discretionary basis. Other accounts may or may not be managed on a discretionary basis. It would be determined by the client if they choose to do so. Typical holdings for client’s account would include the following, but not limited to; mutual funds, exchange traded funds, common stocks, preferred stocks, bonds, closed end funds, exchange traded notes and unit investment trusts.

BAM offers to anyone, a complimentary meeting and opinion on their current investments, investment strategy, and the validity of their current plan to achieve their stated goals. BAM will provide a detailed printed analysis of their current investments, which they can take with them after the complimentary meeting.

BAM interacts with the investing public as a Fiduciary. BAM can also offer advisory services and advice without managing one’s account(s).

Get In Touch

414 D’Onofrio Drive,

Suite 220 Madison, WI 53719

(608) 695-5396

bill@bridgeportam.com